The Chinese Market needs a system whereby MicroFinance lenders can extend their reach deeper and deeper into the hidden market of rural households. GRND8 is an initiative that focuses primarily on bringing access to this market. Not only does GRND8 provide a platform for social interaction between customers and businesses but also a sensible, financial tracking system. This application allows customers to trace back through ongoing financial payments as well as monitoring their own finances in conjunction with finance lenders.

The need for these product/services is directly a result of critique from the Head of The Microfinance Association in China, who says that China needs a system that can be mass produced at a low cost to suit the needs of the customer. Such a system does not exist and GRND8 seeks to solve this problem by directly planting its roots into the Chinese Market.

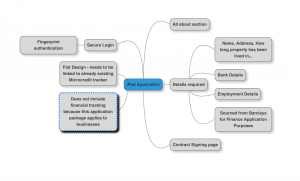

GRND8 offers two accessible packages for customers/businesses. The business package allows customers to complete financial applications with a secure login interface. Both packages offer financial tracking, however the customer package is focused on the customer’s own personal finances as a whole with an all-inclusive calendar system to pinpoint and locate specific payments and expenses.

Funding would primarily go towards mass production of a computerised, mobile system as well as marketing and promotional advertising needed to export the product.