Direct Costs

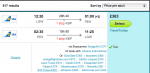

The main cost around producing this project would be gathering marketing data from rural Chinese households. Of course this would be travelling to China and staying in affordable accommodation that is travelling distance away from these households. The price comparison website skyscanner.net is extremely useful for finding the lowest costs of both flights and hotels. I estimate that the research would take 10 days to produce in order to ask a feasible amount of people.

The price of hotels varies between the affordable costs of £263-£393. Anything below £400 would be ideal for this kind of research. Then travel and eating costs must be factored into the research trip which I estimate would be around £300 for 10 days worth of research if done on a budget. However this could have a leeway of +20% if needed.

For this project I have used/plan to use the majority of design elements within the Creative Cloud suite. Using the programmes inDesign, Photoshop, Illustrator and Muse. To rent the Creative Cloud suite it would be £38.11 a month.

(http://www.adobe.com/uk/creativecloud/business/teams.html?promoid=NLMHRH83&mv=other)

I estimate that the project would be completed over the course of two months which would bring the software package to £76.22 for 2 months.

Indirect Costs

According to creativereview.co.uk the average UK design daily rates (per 8-hour day) are:

Junior designer: £100

Midweight: £130

Senior: £250

Design director: £275

(http://www.creativereview.co.uk/cr-blog/2013/january/on-the-money/)

Considering the market research and the scope of designing the product and associated services which include two package applications for customers and businesses as well as a website I would charge £18/hr per 8-hour day to sustain the amount of work required to be completed. I may choose to work in a team in which case the workload would be shared but completed in a shorter amount of time. Which could be ideal and they would be on similar wages.

Other Costs

Based on the fact that major social media networking sites are blocked in China due to political ideologies Facebook cannot be used to advertise to users. Therefore other means of promotion and marketing are needed. The Chinese equivalent, Weibo, does not display banner ads but moreso focuses on interactive ads:

“Our aim is to allow advertisers to retain loyal customers through interactive forms of ads and help them to directly drive sales, not just selling advertising space,” Wang told an interviewer from ShanghiDaily.com (http://socialgarden.com.au/social-media-marketing/how-to-advertise-on-weibo/)

Weibo Statistics:

- 600 million users

- 176 million active users per month

- 50.1 percent male users, 49.9 percent female users

- 82 percent of Weibo users shop online

- 70 percent use the mobile app to access Weibo

Setting up advertising and associated costs on Weibo would require contacting them directly.