As a continuation of the Money Matters EYA Category I have decided to continue my focus on micro-finance. However, rather than focus on assisting businesses and students on financial advisement, I would rather focus on provided micro-finance to areas of the world that ordinarily would not have access to such facilities. AWAMO are very much so focusing on bringing micro-finance options Sub-Saharan Africa full stop. A key consideration is their security policy with fingerprint identification, ‘In many instances, crime and violence act as a significant deterrent to investment and in some cities large areas have become literally ungovernable.’ (Hove, Muchemwa and Ngwerume, 2013).

MicrofinanceGateway provides significant articles and analyses on global micro-finance. In particular, a report from Mr. Du Xiaoshan, Chairman of China Microfinance Association, reflections on Micro Finance and Risk Management. He stated that a major constraint of development is sustainability and the ability of respective finance lenders. Furthermore research by scholars suggests that ‘since NGO MFI services mostly cover remote underdeveloped or sparsely populated areas, it is worth exploring whether they can take advantage of technologies like mobile banking, POS-devices and computerised MIS systems at low cost and large scale.’ Therefore a lack of technological access has significantly reduced the ability of smaller microfinance lenders to be able to access their market.

The proposed product will seek to solve this issue by providing an MFI system that can deliver this infrastructure to rural areas e.g. farming households, in China.

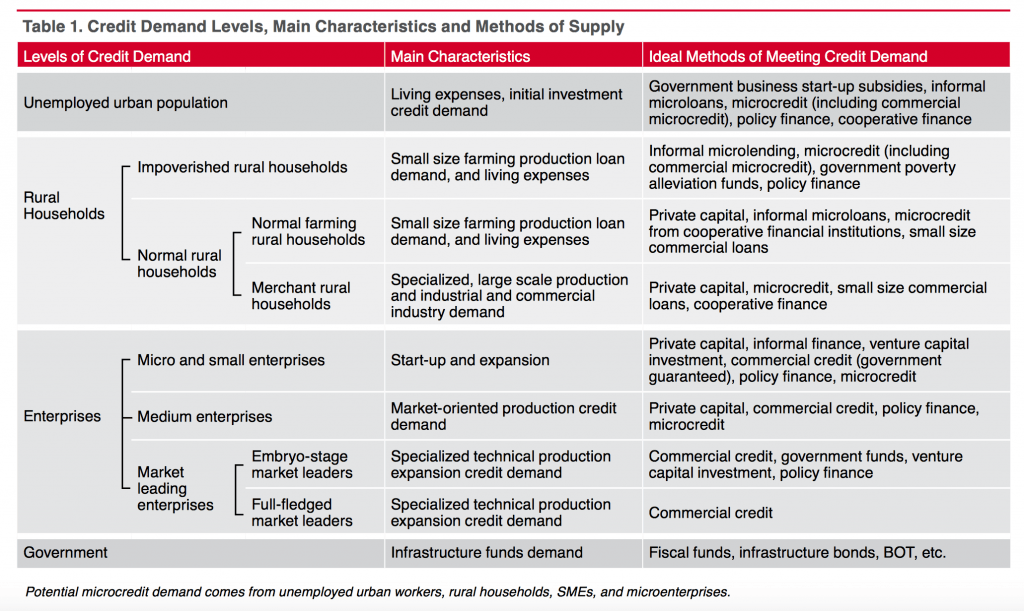

In An Analysis of Microfinance Demand in China by He Guangwen a table provides analysis of the ideal methods of meeting credit demand. In particular, the ideal methods for rural households can be targeted by microcredits/microcredits from cooperative financial institutions.

In The Current Situation and Future Prospects for Microfinance in China, Xiaoshan states that NGO MFI services over remote undeveloped/sparsely populated areas. The development of these areas can be further explored through the use of the availability of technologies like mobile/tablet/computerised applications.

The proposed product has the potential to be exactly what is needed to bring access to the undeveloped/sparsely populated areas. A system that would be used by MFI services to further spread the influence of micro-finance loans. I suggest the implementation of all the suggested technologies by Xiaoshan to do exactly this.

When identifying whether there is a need for these services to be provided for the people in these areas it is important to see whether the necessary technologies are necessary. An article by Shrader (2013), explores how almost every household in China has access to a bank account. However, ‘ There is a clear recognition that poorer families, particularly those in remote areas, have trouble accessing accounts and use them mainly for encashment, which can often require costly travel to bank branches or ATM in distant cities and towns.’ The inclusion of mobile banking at low cost and large scale can provide access to these families and households.